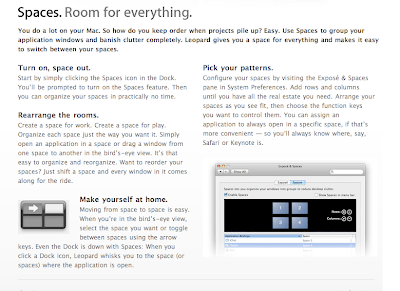

After getting frustrated with my current set up and contemplating buying several monitors for real, I decided to give this a try first to see whether I could get the same basic functionality out of a virtual multi-monitor set up. I'm taking advantage of the "Spaces" technology from Apple to set up 6 distinct virtual desktops:

Anyway here is my set up:

I have 4 screens for watchlists, so I can separate the combo lists from the short list and also have some room to chart what comes off the hod list. The 5th screen is for the chat and the 6th is for IB. The 7th you ask? That is where I run Windows XP in the background where I have Scottrade Elite running Trade Ideas (detailed here) with my backfiltered list of deadly combo stocks (detailed here).

The great thing about this set up, actually the only thing that really makes it functional, is the fact that I can set each window to a quick key for instant and direct access. I find this direct pivot actually to be about the same as moving one's eyes and refocusing on a new screen. Anyway if I find that it just isn't working out then I will invest in a multi-monitor set up. But for now this has the advantage that I can bring it with me wherever I go, like now.

** UPDATE

To clarify about Spaces- it is true, for obvious reasons if you think it through, that an application can only exist in one space only. To get around this problem I use a different web browser in each space. Therefore, the number of spaces ("watchlist monitors") is really only limited by this, since the number of virtual windows you can create is limitless. There seems to be no shortage of browsers available so this is not a problem. I use: Safari, Firefox, Camino, Seamonkey, Stainless, and Opera. Of course IE is also available (puke) and a few others probably. I can also use Chrome on the Windows side, although there is no need since that does not exist on the Spaces interface so I can have multiple browsers open there as well (I run the hod list from Firefox; running it on the Windows side allows for the freeze frame technique).